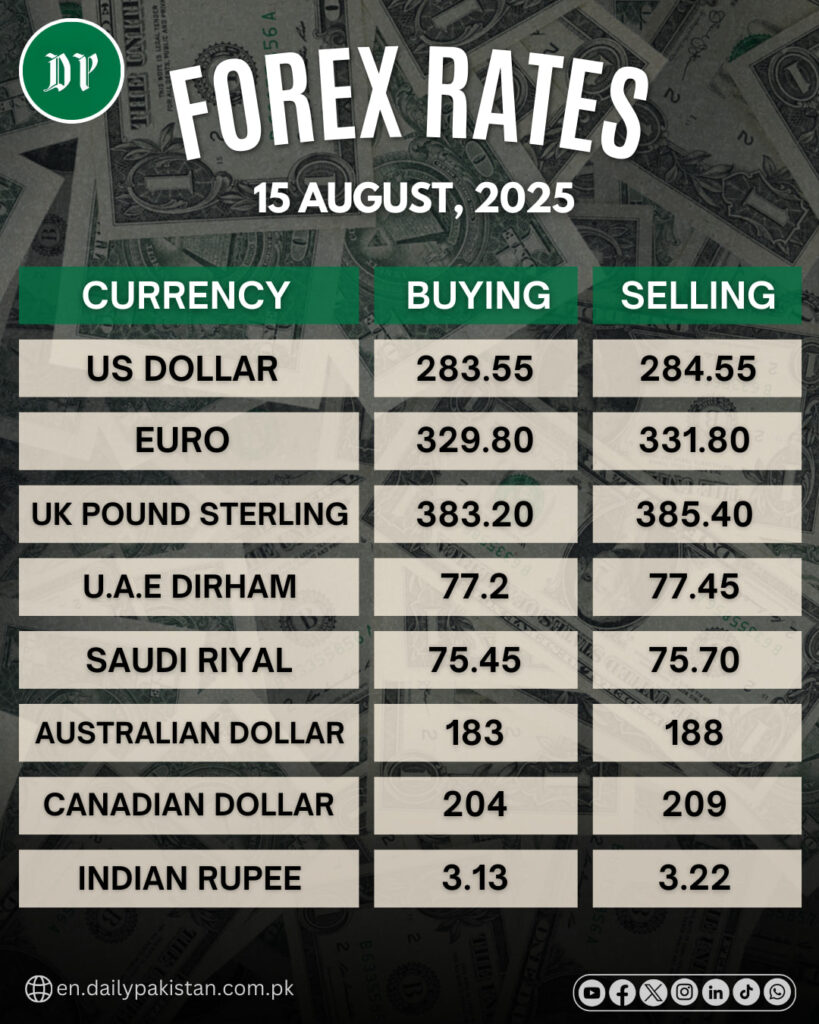

Current Exchange Rates (Approximate)

It’s a surprise that in a surprising twist, the Pakistani rupee is gaining strength against the major currencies of the world that include the dollar euro, riyal, pound and dirham. This is evidence of improved the stability of the economy and increasing confidence in the Pakistani financial system. Even though there is still a lot to be done but the present trend provides some cautious optimism for Pakistan’s economy. This is especially important because Pakistan has faced challenges with debt, inflation as well as forex supply problems in recent times. The stronger rupee is now a sign of not just a temporary relief, but also the possibility of a path to long-term financial security.

These figures underscore a clear depreciation trajectory: higher PKR values per unit of foreign currency reflect a weaker rupee globally, but in Pakistan’s case, the rupee has shown surprising resilience.

| Currency | Code | Rate Against PKR (Approx.) |

|---|---|---|

| Euro | EUR → PKR | ₨330 – ₨332 |

| British Pound | GBP → PKR | ₨382 – ₨384 |

| Saudi Riyal | SAR → PKR | ₨75 |

| UAE Dirham | AED → PKR | ₨77 |

Why Are These Prices Falling Against the Rupee?

(i) Broader Economic Recovery

In recent years, Pakistan grappled with economic turmoil—soaring inflation, low forex reserves, external debt, and political instability. However, signs of recovery are emerging: inflation has cooled, reserves are stabilizing, and growth is gradually picking up. This has restored confidence in the rupee, reducing the demand for foreign currencies.

(ii) Strengthened Macroeconomic Fundamentals

IMF-backed reforms and tighter monetary policy have helped Pakistan rein in inflation. Improved remittances and a current account surplus have also strengthened the rupee’s footing.

(iii) Flattening of Premiums in Open Market

Earlier, the rupee traded at significant discounts in the open market compared to official rates, largely due to demand-supply gaps. With better FX availability and reduced speculation, the market has stabilized, lowering premiums.

Impacts on Pakistan’s Economic Landscape

Consumers & Importers

Cheaper foreign currency helps reduce import bills, especially for fuel, raw materials, and electronics. This brings partial relief to inflation-struck consumers.

Remittances Sector

Overseas Pakistanis sending money home may see smaller returns in rupee terms, but the stability helps ensure families can rely on consistent exchange rates.

Trade Balance & Inflation

A stronger rupee lowers import costs, easing inflationary pressures in food and energy, and helping stabilize household expenses.

Investor Sentiment

A steady rupee improves investor confidence, encouraging more foreign inflows into Pakistan’s financial markets.

Outlook & What’s Next?

External Variables

Global interest rate moves, commodity prices, and geopolitical developments can still affect the rupee’s stability.

Policy Vigilance

Prudent fiscal management, controlled government spending, and healthy reserves will be key to maintaining the rupee’s strength.

Structural Reforms

Pakistan needs to boost exports, reduce import dependency, and expand industrial productivity to achieve sustainable currency stability.

Conclusion

The fall of the pound, euro, riyal, and dirham against the Pakistani rupee reflects a turning point in Pakistan’s economy. While challenges remain, the rupee’s resilience signals improving confidence and cautious optimism for the country’s financial future. Long-term stability, however, depends on continued reforms, prudent policies, and global economic conditions.